Get all the functions related to picking and packing in the Send for exp pick-pack option. You can set the preferred as well as alternate vendors for streamlining your purchase process. Moreover, creating purchase orders has become efficient with all the vendor information updated automatically. A new Items table has been added to the Vendor Center containing all the items related to a specific vendor.

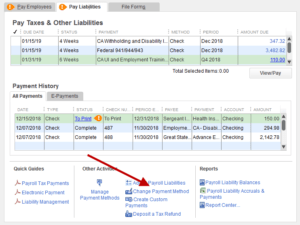

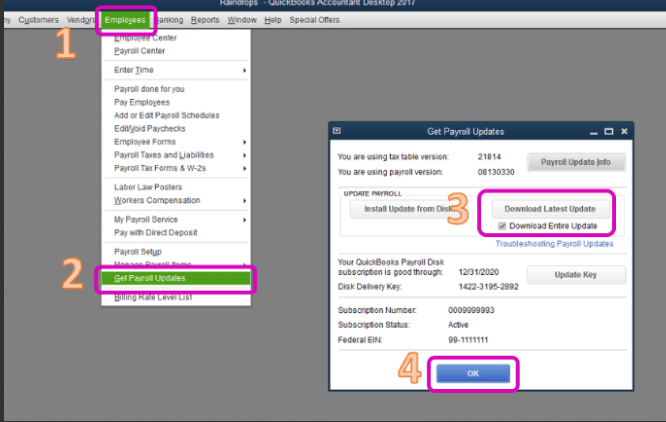

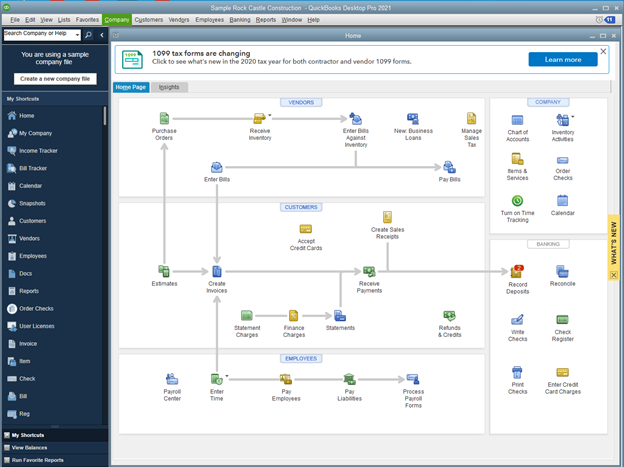

QuickBooks Enterprise Platinum 2020 has a centralized portal called the Vendor Center for easy access to vendor information. can be included in determining the actual cost of the inventory items. All the items related to freight, shipping, insurance, etc. With this feature, you can calculate the product costs more efficiently. Go to: Employees > View Payroll Run Status New Features for QuickBooks Desktop Enterprise Platinum 2020 1. You can view the payroll status by clicking on the Employees option in the menu bar. With the new payroll status feature in QuickBooks Desktop 2020, the employers can see the status of the payroll of the employees that are paid through direct deposit. It offers you a compact view of the long-detailed report that was displayed in the previous versions. Once you open the Customer:Job or Class reports, on the top of the page you will find a Collapse Columns option. In QuickBooks Desktop 2020, you can expand or collapse columns, which was not included in any of the previous versions. The company file can be stored on your network drives, local storage, or removable devices like USB. With the Find a Company File button in the No Company Open window, you can easily search for any company file. Note: The reminders can also be seen in the Invoice Tracker. Once the reminder date arrives, all the customers will start showing in the Review & Send Payment Reminders. Once the reminders pass their set date, they start showing in this option.įor example, you can make a list of all the customers that are regularly late in paying and set a reminder of 5 days before the due date. The third step is to send reminders from the Review & Send Payment Reminders. Moreover, you can also draft a reminder email template that will be sent on the set date. Once the customers have been added in the mailing list, you can set the payment reminders from the Schedule Payment Reminders option. In QuickBooks Desktop 2020, you can streamline the payment process by setting payment reminders for customers.įirstly, you have to create mailing lists and add customers to the list in the Manage Mailing List option in the Customers drop-down menu. Send Customer Payment Reminder Automatically From File > Send Forms and tick on the box “ Combine forms to a recipient in one email” 3. You can use this feature by selecting the File option from the Menu. Hence, if you wanted to send invoices of two separate jobs, you would have to send them in different emails. However, the thing to note here is that you can send the invoices pertaining to a single job only. This feature is beneficial to customers as it cuts down the number of emails sent to the customers as they do not have to attach each invoice to a separate email. With this new feature included in QuickBooks 2020, you can now send a customer multiple invoices in one email. After you have selected the template, click on Edit and go to Insert Field > Customer-PO-No. To add the PO field, you have to go to the menu bar and click on Edit > Preferences > Send Forms > Company Preferences. The QB users can now add the Purchase Order of the customers in the subject line by modifying the email templates for the customer invoices. To keep better track of customer details, Intuit has introduced the PO field in the subject line of emails. New Features for QuickBooks Desktop 2020 – Pro, Premier, Accountant, and Enterprise 1. Let us look at all the new and improved features that the QuickBooks 2020 has in store for us. The payroll process has improved, along with easy company file search and payment reminders, among others.

Similarly, this year as well, QuickBooks 2020 comes with some essential features for the customers. The previous version – QuickBooks Desktop 2019 saw some new features like Invoice Tracker, Go to Pay Bills button, and improved IIF Import feature, etc. Inuit has launched the latest version of QuickBooks Desktop – QuickBooks Desktop 2020.

0 kommentar(er)

0 kommentar(er)